- Fixed Income

- Who We Serve

- Capital Markets

- Current Offerings

- Weekly New Issues

- Certificates Of Deposit

- Incapital InterNotes® / Corporate Debt

- Impact Investments ESG

- Municipals

- Preferreds

- Sovereigns, Supranationals And Agencies (SSA)

- Investor Education

- Market-Linked Products

- BondNav®

- About

$3.5 billion+ of ESG investments underwritten & distributed since 2005

Home » Capital Markets » Impact Investments ESG

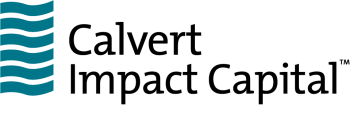

The InspereX Impact Investment Platform provides issuers and financial professionals the opportunity to offer investors a broad range of products that align financial goals with personal values. We’ve been a leader in impact investing since 2005.

InspereX:

- contributes frequently to financial and trade publications on the topic of impact investing, as well as publishes thought leadership

- belongs to The Green Bond Principles, The Social Bond Principles, and The Sustainability Bond Principles, and;

- supports the UN’s Sustainable Development Goals.

Impact Issuers

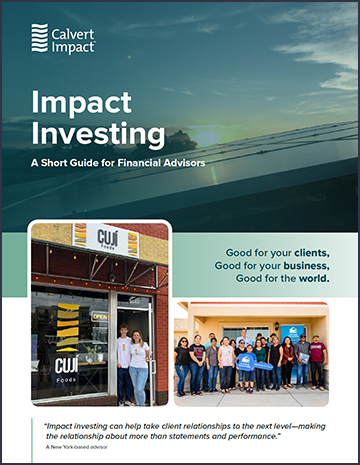

Calvert Impact

Calvert Impact, a nonprofit Impact Investment issuer, launched the Community Investment Note® on InspereX’s platform in 2005 to support organizations creating positive social change through initiatives including affordable housing, education, health and the environment.

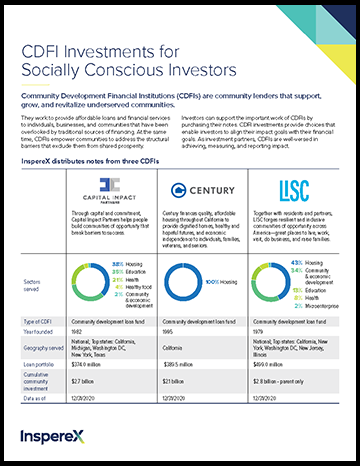

Capital Impact Partners

Capital Impact Partners launched Capital Impact Investment Notes in October 2017. A nonprofit Community Development Financial Institution (CDFI), Capital Impact Partners provides financing and technical assistance to underserved communities nationwide. Through its social impact work, it creates access to health care, education, housing, and community development for those most in need.

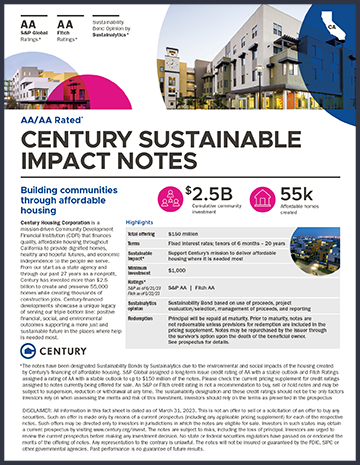

Century Housing Corporation

Century Housing Corporation is a mission-driven Community Development Financial Institution (CDFI) that finances quality, affordable housing throughout California to provide dignified homes, healthy and hopeful futures, and economic independence to individuals, families, veterans, and seniors. Century developments work toward positive financial, social, and environmental outcomes in places where help is needed most.

International Finance Corporation

International Finance Corporation, the largest international development institution focused on the private sector, launched Impact Notes in March 2014. IFC’s mission is to eradicate poverty and boost shared prosperity by supporting private sector development and job creation in more than 100 developing countries.

Local Initiatives Support Corporation

Local Initiatives Support Corporation launched LISC Impact Notes in November 2020. LISC is a national nonprofit Community Development Financial Institution (CDFI) with a 40-year track record of delivering social and financial impact through technical assistance and financing to underserved U.S. communities. LISC invests in affordable housing, quality schools, growing businesses, accessible services, and other vital community projects.

The World Bank

The World Bank (IBRD) is an international organization that provides project loans and technical assistance to help its member countries end extreme poverty and promote shared prosperity.

Impact Investing Resources

U.S. AgenciesOverview

U.S. AgenciesOverview

(login required to access)

Institutional Sales

Capabilities

Institutional Sales

Capabilities

(login required to access)

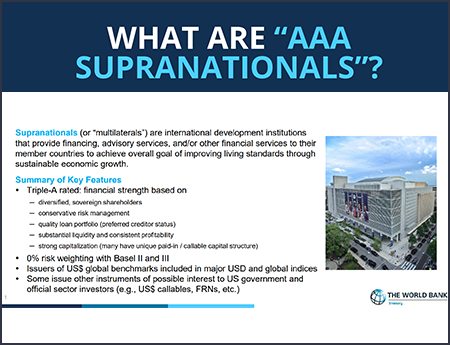

The World Bank andOther Supranationals

The World Bank andOther Supranationals

(login required to access)

Calvert Impact Investing Guide for Advisors

Calvert Impact Investing Guide for Advisors

(login required to access)

Capital Impact Investment

Notes: Opportunities for Investors Video

Capital Impact Investment

Notes: Opportunities for Investors Video

(login required to access)

Century Investor

Presentation

Century Investor

Presentation

(login required to access)

LISC Investor

Presentation

LISC Investor

Presentation

(login required to access)

Calvert Impact Capital, a nonprofit Legacy™ issuer, launched the Community Investment Note® on InspereX’s platform in 2005 to support organizations creating positive social change through initiatives including affordable housing, education, health and the environment.

- Impacts are organized into three main themes of strengthening communities, increasing access to capital and developing solutions to address climate change.

- Since inception, the Community Investment Note® has mobilized capital from more than 18,000 investors.

Capital Impact Partners launched Capital Impact Investment Notes in October 2017. A nonprofit Community Development Financial Institution (CDFI), Capital Impact Partners provides financing and technical assistance to underserved communities nationwide. Through its social impact work, it creates access to health care, education, housing, and community development for those most in need.

- Capital Impact Investment Notes are investment-grade rated* by S&P Global. Out of approximately 1,200 CDFIs in the United States, less than 1% are S&P rated.

- In the past 30 years, Capital Impact Partners has invested billions of dollars in projects that deliver social impact. Capital Impact Investment Notes will help expand that footprint.

Century Housing Corporation launched Century Sustainable Impact Notes in February 2021. Century is a mission-driven Community Development Financial Institution (CDFI) that finances quality, affordable housing throughout California to provide dignified homes, healthy and hopeful futures, and economic independence to individuals, families, veterans, and seniors. With an emphasis on energy efficiency and transit-oriented housing, Century developments work toward positive financial, social, and environmental outcomes in places where help is needed most.

- Century Sustainable Impact Notes are aligned with the International Capital Market

Association’s Sustainability Bond Guidelines and the United Nations Sustainable Development Goals. They are investment-grade rated* by S&P and Fitch.

- From its start as a state agency and through the past 25 years as a non-profit, Century has invested more than $2 billion to create and preserve 44,000 homes while creating thousands of construction jobs.

IFC, the largest international development institution focused on the private sector, launched Impact Notes in March 2014. IFC’s mission is to eradicate poverty and boost shared prosperity by supporting private sector development and job creation in more than 100 developing countries.

- IFC’s projects must adhere to stringent environmental and social requirements focusing on transparency and accountability.

- InspereX distributed IFC’s first U.S. Green Bond designed for individual investors issued through IFC’s Impact Notes program in September 2014.

Local Initiatives Support Corporation launched LISC Impact Notes in November 2020. LISC is a national nonprofit Community Development Financial Institution (CDFI) with a 40-year track record of delivering social and financial impact through technical assistance and financing to underserved U.S. communities. LISC invests in affordable housing, quality schools, growing businesses, accessible services, and other vital community projects.

- As one of the country’s largest organizations supporting projects to revitalize communities and grow local economies, LISC and its affiliate organizations have invested more than $24 billion since 1979.

- Aligned with The Social Bond Principles and UN Sustainable Development Goals, LISC Impact Notes help finance community and economic development projects across 38 cities and 2,400 rural areas in 49 states. They are investment-grade rated* by S&P Global.

The World Bank (IBRD) is an international organization that provides project loans and technical assistance to help its member countries end extreme poverty and promote shared prosperity.

- World Bank is owned by 189 nations who are also its borrowers. Of these member countries, the United States is the largest shareholder.

- For over 65 years, investors in the U.S. and around the world have helped fund IBRD’s worldwide activities by investing in World Bank bonds. World Bank bonds have been rated AAA by S&P Global and Fitch since 1959.

ESG Policy Statement

InspereX’s focus in the ESG space has been making a demonstrable impact. We have been a pioneer in making impact investments available to all investors. We continue to build on our historic commitment to communities in underserved areas through the values-based investing sector.

As an underwriter and distributor of new issue offerings, InspereX has been at the forefront of supporting impact investment issuers. In 2005, we began offering Calvert Impact Capital’s Community Investment Notes. To date, Calvert Impact Capital has reinvested over $800 million in proceeds in the U.S. and in over 100 countries to build affordable housing, finance small businesses, develop renewable energy solutions, and provide essential community services.

In 2011, we furthered our participation in values-based product distribution when we began underwriting for the World Bank, a supranational with a mission to end extreme poverty and boost shared prosperity.

Fast forward to 2014, InspereX solidified our leadership role with the launch of our impact investing platform to enable issuers and financial professionals to offer investment products that combined financial goals with personal principals. That year, International Finance Corporation, part of the World Bank Group, became the first supranational to launch a debt program directed to U.S. individual investors with InspereX as the sole agent. IFC issued its first retail Green Bond that same year as a programmatic note offering. The World Bank followed IFC with a note program through InspereX in 2015. We have raised over $1 billion for these two supranationals combined.

InspereX was also the first to distribute public debt on a programmatic basis for a Community Development Financial Institution (“CDFI”) and now serves as the lead agent for two additional CDFIs. Capital Impact Partners joined in 2017, followed by Local Initiatives Support Corporation in 2020, and Century Housing Corporation in 2021. CDFIs are community lenders that support, grow, and revitalize underserved communities. They lend and service loans in geographies often overlooked by traditional banks. At the same time, they empower communities through technical assistance to address the structural barriers that exclude them from the economic mainstream.

Through the InspereX impact investing platform, we continue to aggressively seek issuers focused on social policy and sustainable environmental initiatives, including those issuers striving to effect positive change in environmental, social, and governance initiatives.

We are proud of the measurable impact we have achieved in the values-based investment space. On behalf of eight impact issuers, to date, we have raised over $2.8 billion. Those funds have been put to important use that have directly and positively impacted many communities and their residents.

Beyond our efforts raising capital in support of our values-based investment issuers, we have looked within our organization to facilitate employee engagement as we continue to focus on social impact and sustainability opportunities. The firm’s Diversity Council plays a critical role in our efforts. In conjunction with our Human Resources Department, it works to source candidates to expand the diversity of our workforce. Likewise, we have taken steps at our parent level to formulate a more diverse Executive Board. The Diversity Counsel also seeks out mentorship opportunities for high school and college students from underserved communities.

With respect to sustainable environmental issues, we have expanded work from home opportunities and further reduced our carbon footprint by securing smaller office space in each of our office locations and our largest office by revenue and headcount. We also continue to work in conjunction with management at each office location to develop and deploy energy conservation, recycling, and related efforts.

As a small firm with limited resources, our overriding objective in the ESG space is to directly and measurably impact the communities we serve.

* Ratings current as of [datetoday]. A credit rating is not a recommendation to buy, sell, or hold securities, and is subject to revision or withdrawal at any time, and without notice, by the assigning rating agency. Each rating should be evaluated independently of any other rating and investors should conduct thorough due diligence before investing. Investors should refer to the respective offering documents for information on the use of proceeds of each offering.

* Ratings current as of [datetoday]. A credit rating is not a recommendation to buy, sell, or hold securities, and is subject to revision or withdrawal at any time, and without notice, by the assigning rating agency. Each rating should be evaluated independently of any other rating and investors should conduct thorough due diligence before investing. Investors should refer to the respective offering documents for information on the use of proceeds of each offering.

Impact Investments

Impact Investments CDFI

CDFI CDFI

CDFI Calvert Impact

Calvert Impact Calvert Impact 2023 Report

Calvert Impact 2023 Report Capital Impact Partners

Capital Impact Partners Capital Impact Partners

Capital Impact Partners Capital Impact Partners Impact Framework

Capital Impact Partners Impact Framework Century Housing

Century Housing Century Sustainability Bond Framework

Century Sustainability Bond Framework IFC Investor

IFC Investor IFC Green Bonds

IFC Green Bonds IFC Social Bond

IFC Social Bond IFC Impact Notes

IFC Impact Notes IFC US Investors

IFC US Investors IFC Social Bond

IFC Social Bond IFC Social Impact Notes

IFC Social Impact Notes LISC Impact Notes

LISC Impact Notes LISC Impact Notes

LISC Impact Notes LISC Impact Notes

LISC Impact Notes The World Bank 2022

The World Bank 2022 The World Bank

The World Bank The World Bank

The World Bank The World Bank and Supras Presentation

The World Bank and Supras Presentation The World Bank Triple A Video

The World Bank Triple A Video